Being a contractor

Please watch the overview video below (coming soon)

What are the key components and questions for a contractor business owner to ensure financial stability and financial success...?

Profit potential

What's the potential profit you could make as a contractor and is it financially viable for you?

Financial health

What are the industry healthy ratios and budget guidelines for your contractor business expenses vs other businesses?

Business expenses

What are the common business expenses most contractor business have to pay each year?

Record keeping

What is the best practice ideas for keeping your financial records and documentation and organising your financial data?

Having a Budget

What's your budget for your contractor business that shows a financial guide and path you can follow follow

Professional support

What does an accountant and a bookkeeper do, and do you need professional support from them?

Start how you want to finish...with a plan, with clear budget guidelines and with a financial map and path that guides you

Starting your own contracting business as is a common option for many allied health professionals who are newly graduated or transitioning from being an employee to a business owner and contractor. Running your own business requires careful attention to ATO obligations , GST and record keeping requirements and also in being conscious of running your contracting business in a financially sustainable manner

Step 1. Onboard with a Registered Tax Agent

Your business will need an Accountant/registered tax agent for ongoing support each financial year to:

-

do your end of year tax

-

advise you with business registrations and higher level advice.

If you don't have an accountant let us know (contact us using the contact form on this website) and we will refer you to an allied health specific accountant asap.

Step 2: Business Feasibility analysis

Should you even be running a business? Assess if its actually financially sustainable and financially feasible for you to start your own business or practise including

a) what potential profit can you make, b) what will your potential sales income and expenses be and c) what are healthy budget guidelines for your expenses? If you aren't sure how to do this, purchase our Business Feasibility report below and we will do that analysis for you.

Step 3: Setup a Bookkeeping system

At the heart of every business and central to its financial success is a financial system (software to record all your business income and expenses, analyse your profit, comply with ATO and GST and record keeping compliance obligations and organise your data in a logical way for your accountant to do your year end business tax return. If you've already done Step 1 and 2 and are going ahead with your business launch, contact us about setting you up on XERO

watch a video overview of the calculator in action

I want to be a Contractor Feasibility analysis calculator

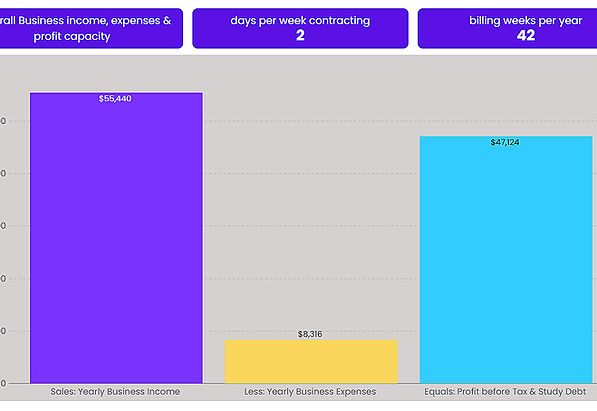

Our FMap Independent Contractor feasibility analysis calculator and report with mini training video included for both new and existing Allied health Contractors which will analyse and report on:

-

Your working weeks per year (available billing weeks & leave per year)

-

Your potential yearly contractor business income

-

Your estimated yearly potential contractor business expense's

-

Your estimated yearly potential profit before tax and before study debt

-

Your estimated draft yearly profit and loss for your contractor business based on actual real world example data from other contractor businesses of a similar size

$365.00

Price includes:

-

Our team producing a comprehensive PDF report on your potential sales, expenses and profit from your contracting business

-

A custom video analyzing your initial report outcomes and also discussing key concepts of being a contractor in a mini training video

-

Phone and email support for adjustments to draft report